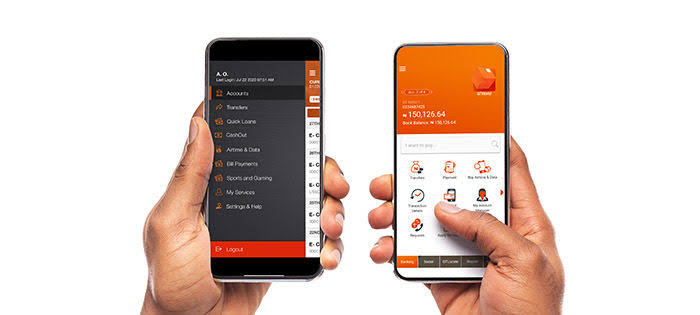

You’re probably a first-time Ecobank user, and you are looking for ways how to download and activate the Ecobank mobile app on either your Android or iOS device; I have got you covered.

Ecobank still remains the best bank in Africa; it’s sad that many people dont use the bank at the moment, they have good customer service and seamless apps.

Top 6 Features of the EcoBank Mobile App

Before we go into the download and activation steps, here are some standouts of the EcoBank Mobile App you need to know:

- Instant money transfers – Send and receive money easily across multiple accounts.

- Bill payments – Pay for utilities, subscriptions, and other services.

- Airtime top-up – Recharge your phone directly from the app.

- Cardless withdrawals – Withdraw cash from ATMs without a debit card.

- Security features – Enjoy biometric authentication, PIN protection, and OTP verification.

- 24/7 banking – Access your account at any time from anywhere.

Now that you are aware of these features, let’s dive into the the download and activation process.

Read also: How to Download, Register and Activate Access Bank Mobile App in 2025

How to Download EcoBank Mobile App on iOS Devices

If you use an iPhone or iPad, follow these steps to download the EcoBank Mobile App:

- Open the App Store – Unlock your iPhone and open the Apple App Store.

- Search for ‘EcoBank Mobile App’ – Use the search bar to find the official EcoBank banking app or download here.

- Tap ‘Download’ or ‘Get’ – Once you locate the correct app, click the download button.

- Install and Open – Wait for the installation to complete, then open the app.

- Grant Permissions – Allow the app access to required permissions such as notifications and location services.

How to Download the EcoBank Mobile App on Android

For Android users, here’s how you can download the EcoBank Mobile App:

- Open Google Play Store – Unlock your Android device and open the Google Play Store.

- Search for ‘EcoBank Mobile App’ – Type the app name in the search bar or download here

- Select the official app – Look for the verified EcoBank app.

- Tap ‘Install’ – Click on the ‘Install’ button to download the app.

- Launch the App – After installation, open the app and accept the necessary permissions.

If you have successfully installed the mobile apps on your devices, the next is to activate the mobile app. The activation process is quite easy and simple; let’s dive into it together.

How to Activate EcoBank Mobile App

Once you have successfully downloaded the app, you need to activate it to start using its features. Follow these steps:

For New Users:

- Open the App – Launch the EcoBank Mobile App on your iPhone or Android device.

- Select ‘Register’ – Choose ‘Sign Up’ if you are a first-time user.

- Enter Your Details – Provide your EcoBank account number and registered phone number.

- Verify Your Identity – An OTP (One-Time Password) will be sent to your phone. Enter the OTP.

- Create a PIN/Password – Set up a secure 4 or 6-digit PIN for logging in.

- Complete Registration – Once verified, your account is now activated.

For Existing Users:

- Open the App – Launch the app and tap on ‘Login’.

- Enter Your Credentials – Input your registered phone number and PIN.

- Verify with OTP – An OTP will be sent to your number for security verification.

- Access Your Account – Once verified, you can start using the app for transactions.

Now, for the first-time user, it might not work depending on the kind of account that you are using; you might need to go to the bank to activate your mobile app or use your ATM card details to activate the app.

Frequently asked Questions About EcoBank Mobile App

1. Is the EcoBank Mobile App free to use?

Yes, downloading and using the EcoBank Mobile App is free. However, some transactions may incur standard banking fees.

2. Can I use the app without an EcoBank account?

No, you need an EcoBank account to register and access banking services. So visit the bank and create a new account, then link the account with the Ecobank mobile app.

3. What should I do if I forget my PIN?

You can reset your PIN by selecting ‘Forgot PIN’ on the login page and following the instructions. However, you might need to contact customer service if you are unable to reset your password.

4. Is the app safe for transactions?

Yes, the EcoBank Mobile App uses advanced encryption and security measures like biometric login and OTP verification. Ecobank is fully registered with CBN and trusted by millions of Africans; they have been in existence for over 40 years now.

5. Can I access my account on multiple devices?

Yes, but for security reasons, you may need to verify each new device using OTP authentication.

6. How can I contact customer support?

You can reach EcoBank customer service via the app’s support section, the official website, or by calling their customer care line, or call Ecobank customer care here at 0700 500 0000

Conclusion

The EcoBank Mobile App is something everyone can use without facing issues; they are fast and reliable, and more so, they respond fast to your complaints 247. Have you downloaded your own eco bank app? Share your experience in the comment section.